.jpeg)

A dwelling fire policy - or DP insurance policy - is designed for landlords with rental property that standard homeowners insurance does not cover. Despite the name, these policies cover more perils than a fire.

There are three policies under this umbrella, which can sometimes confuse beginner and experienced landlords alike. Choosing the right coverage between the three - DP1, DP2, and DP3 - requires one to pay closer attention to what each policy does and does not cover.

If you are wondering whether DP2 is the right policy for your property, this article provides all the answers. You will learn what a DP2 policy is, what it covers, what it does not cover, when you can use it, and other options to consider if it is not the best coverage for you.

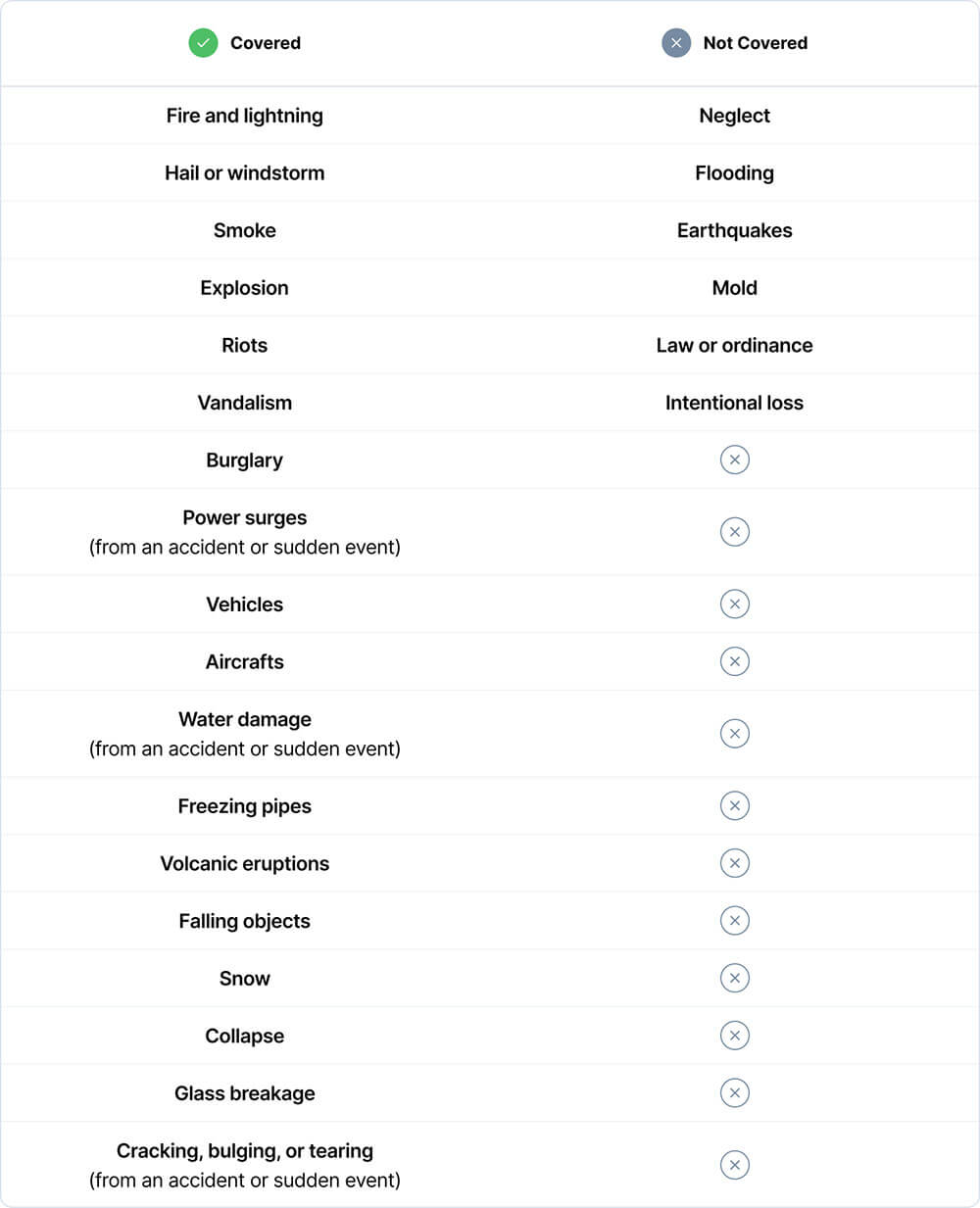

A Dwelling Fire Form 2 policy is insurance coverage for rental properties, commonly known as DP2 or broad form. It is a named peril policy covering only the perils named in the policy. In short, it does not provide you protection against any risk that is not explicitly stated in the policy. There are 18 named perils in a DP2 policy, usually available from all insurers.

Second, DP2 is a replacement cost value (RCV) type of coverage. It means that you receive the amount needed to repair damages to the property during a claim. It will save you from footing part of the bill from your pocket like you would with an actual cash value (ACV) policy such as DP1.

For instance, let’s say you were to rebuild a portion of your house after damages from one of the named perils. The cost of repairs is $200,000. Under the DP2 policy, your insurer will pay for the total cost of doing these repairs at the current prices, assuming the losses are below the policy limits. On the other hand, a DP1 policy that uses actual cash value will have a lower payout since the insurance company factors in depreciation.

The DP2 policy covers any damages to the primary structure and detached ones, like garages, sheds, fences, and patios. As mentioned earlier, DP2 has a total of 18 perils:

In addition to these perils, DP2 also provides fair rental value coverage. So if your property is uninhabitable due to any of the named perils and you lose income, your insurer will reimburse you the fair value of the rent up to the limits on your policy.

Considering that you still have to pay some expenses on the property even when vacant, like the mortgage and property taxes, loss of rent coverage is a critical aspect of this policy. It allows property owners to keep earning during such incidents and meet necessary bills without digging into their personal savings.

Out of the 18 perils, you will notice that three are listed as accidental or sudden. As the definitions suggest, insurance companies only pay these claims if the damage results from an accident or a sudden unexpected event from these three perils.

Some insurance companies include personal liability and personal property on the DP2 coverage. However, you must speak with your insurance agent to determine whether this would be available as an addition. If available, keep in mind that the insurance company may treat it as additional coverage at an extra cost.

.jpg)

DP2 policy is like having an in-between option between DP1 and DP3.

For starters, it is more comprehensive than a DP-1 policy. As a landlord, you can get protection against more perils, including theft and malicious mischief that are not available with the DP1 option. Second, it is more affordable than a DP3 policy, allowing you to not settle for less due to budget constraints while still getting a lot of coverage at an affordable price point.

However, the DP2 policy may not be the ideal choice when you have a vacant house. Many landlords want to use DP2 while their property is on the market, either for sale or rental. Unfortunately, many insurers do not allow this.

While DP2 covers more perils than a DP1 policy, it is not the ideal coverage if you have a property that will sit vacant for more than 60 to 90 days. The exact timeframe for this restriction varies between insurance companies.

Insurers avoid covering vacant homes under DP2 because tiny issues that could culminate into more significant damages can go unnoticed. This leads to claims for higher amounts to fix such damages.

If you determine that the DP2 policy is not the right coverage, other dwelling policies to consider are DP1 and DP3.

DP1 is also a named-peril policy but with more exclusions than DP2. In fact, the DP1 policy covers only nine perils, making it a more basic policy for a specific niche of property owners.

It is only ideal when you cannot afford DP2 and DP3 or have a vacant property. In addition, the DP1 policy is an actual cash value type of policy, meaning you do not receive the total replacement cost of the repairs at the current price. The payout is usually less due to depreciation, meaning you may need to go out of pocket to pay for some of the replacement costs.

On the other hand, the DP3 policy covers all perils unless they are explicitly excluded from the policy. This makes it the most comprehensive dwelling policy of the three options and the most expensive. Like the DP2 policy, the DP3 policy also pays the replacement cost value for repairs caused by covered perils (except in some cases for roof repairs based on the age of the roof).

There are several options for finding the best DP2 policy for your rental property:

Obie is insurance built for landlords and real estate investors.

You can obtain easy, affordable, and adequate coverage entirely online through a landlord insurance quote. Furthermore, there are no paper applications to complete or lengthy waiting periods.

Obie streamlines landlord insurance, offering instant quotes in all 50 states. Getting a quote and purchasing a policy online is faster than ever before, making it easy to get covered and protect your investment.

Your existing insurance provider or broker may be a good place to start looking for landlord insurance. This may be the simplest option because you won't have to do much research or compare many quotes from several carriers yourself.

However, while this is the most obvious choice, it isn't always the best way to obtain landlord insurance. Some firms compete on price by providing limited coverage and poor customer service when a claim is submitted.

Do you know of a friend or family member who has invested in rental property? Most likely, they already have landlord insurance. They may discuss their experiences with insurers and lessons learned and recommend coverage or an agent they've used.

Finding the best landlord insurance might be as easy as connecting with other real estate professionals through social media. You can also visit property exhibitions and search for organizations willing to include you in their groups.

The DP2 policy is the best option if your budget does not allow for DP3. It’s a more comprehensive landlord insurance policy than a DP1, which is a more basic landlord insurance policy.

It provides coverage against numerous perils, more than you would get with a DP1 policy. These include fires and smoke, windstorms and hailstorms, freezing pipes, burglary, and vandalism. In addition, you get reimbursed fair rent value by your insurer if a covered peril leads to loss of rental income.

DP2 covers the property’s primary structure and other additional detached ones, like garages. As much as the DP2 policy is broader than a DP1 policy, it does not protect your personal property or cover liability. However, some insurers might be willing to add these to your policy at an extra fee.